11 Best Full-Service Brokers in India 2023

11 Best Full-Service Brokers in India 2023

You should consider a full-service broker if you don’t do more than 3-4 transactions per month.

But if you trade more or want to cut down on your brokerage costs, then go only with a discount broker like Zerodha.

Full-service brokers charge a percentage (0.1% to 0.5%) of the transaction value as brokerage.

The brokerage amount will only be a few hundred rupees if your investment is 10,000-15,000 rupees.

But if your investment is more than 1 lakh, the total brokerage amount will be huge.

If you buy stocks worth Rs. 1 Lakh every month, meaning Rs. 12 lakh in a year, you end up paying 0.5% brokerage (Rs. 6000) plus taxes. Whereas discount brokers charge a flat fee per trade irrespective of the trade volume.

The advantage with full-service brokers over discount brokers are

- research reports

- stock trading tips

- training for trading

- a dedicated manager for addressing your queries

- even stock recommendations

You can learn from them, but I wouldn’t advise you to follow them blindly because the recommendations are not full-proof.

You can compare brokers on the following points –

- Seamless flow of funds between trading and bank account

- Depth of research

- Customer support

- Brokerage charges

Our top pick Demat accounts in India to save on brokerage charges.

You can read on for a detailed review of the 11 best full-service brokers

Best Full Service Broker in India 2023

#1. Angel Broking Review

Angel Broking is a 30 years old full-service stockbroker with a flat brokerage of Rs. 20 per trade. Flat brokerage rates can save huge money if you trade high volumes.

However, their value-added services are limited to stock advisory, investment in bonds (corporate, tax-free, NCD & govt bonds), and US Stocks.

Angel Broking offers an ARQ intelligence tool for checking stock performance and portfolio health.

Brokerage Charged by Angel Broking

| Trading Segment | Brokerage Charges |

| Equity Delivery | Rs. 0 |

| Equity Intraday | Rs. 20 per trade or 0.25% (whichever is lower) |

| Futures – Equity, Commodity, Currency | Rs. 20 per trade or 0.25% (whichever is lower) |

| Options – Equity, Currency, Commodity | Rs. 20 per order or 0.25% (whichever is lower) |

Account opening and AMC Charges

| Particulars | Charges |

| Trading account opening charges | Rs. 0 |

| Demat Account | Rs. 0 |

| Annual maintenance charges | First Year – Free Second Year onwards – Rs. 20 per month |

Angel Broking Trading Platforms

#1. Angel Broking App

Angel Broking mobile app is loaded with multiple indexes with real-time prices.

One can access ledgers, contract notes, P&L statements and can transfer funds & securities from the app itself.

#2. Angel Broking Trade

Angel Broking Trade is a web-based trading platform that helps you invest in Mutual funds, commodities, currencies, mutual funds, bonds, and IPOs.

You can manage the wealth account of the entire family on the trading platform with a single login.

#3. Angel Speed Pro

Angel Speed Pro can be used on multiple PCs for trading and direct market access.

On Speed Pro, you can get instant market news, track market movements and get live market data in excel.

#2. IIFL Securities Full Service Broker Review

IIFL Securities is good for investors who need guidance and research support while making investment decisions. You would get good customer support from the IIFL team.

In fact, more than 25 lakh customers trade with IIFL Securities Ltd.

You would need to pay a percentage-based brokerage. The 3 different brokerage plans available include Investor plan, Super Trader plan and Premium plan.

IIFL Securities also offers value-added services like –

- Research advisory

- Market & sector reports & Information

- Options Trading Using Sensibull

- Mutual Fund Investment

- Wealth & Financial Management

- NRI Equity Investment Services

You can open an IIFL Demat account for Free along with zero AMC charges for the first year.

IIFL Account Opening Charges

- Account opening charges – Rs 0

- First-year annual maintenance charges – Rs 0

- Annual maintenance charges second year onwards – Rs 250 (less than other full-service brokers)

IIFL Brokerage Charges

IIFL securities offer 3 different accounts for all customer needs. Investor plan (online plus), Super trader plan (Pro traders) and Premium plan (dedicated RM).

| Plan Name | Investor Plan | Super Trader Plan | Premium Plan |

| Equity Delivery | 0.25% | 0.10% | 0.50% |

| Intraday/ Futures | 0.025% | 0.01% | 0.05% |

| Options (per lot) | Rs 25 | Rs 10 | Rs 50 |

| Commodity / Currency Trading | 0.025% | 0.015% | 0.050% |

| Currency Options (per lot) | Rs. 8 | Rs. 5 | Rs. 10 |

| Currency Futures (per lot) | Rs. 20 | Rs. 15 | Rs. 25 |

Benefits of IIFL Demat Account

- Free account opening & zero first-year AMC

- Different brokerage plans for various needs

- Research reports on 500+ stocks, sector summary, daily stock tips and recommendations

- Value-added services like IPO & mutual fund investment.

Best Full-Service Broker in India 2023

#3. Sharekhan Stock Broker Review

Sharekhan has two decades of industry presence with 2 million customers and 750+ service managers handling them.

For traders, Sharekhan has smart search and investment pattern finder & alert tools to filter and identify potential stocks.

Their value-added services include portfolio management, loan against shares and investment in mutual funds.

Brokerage fees charged by Sharekhan

| Trading Type | Brokerage Charges |

| Equity Delivery | 0.50% (minimum 10 paise per share) |

| Equity Intraday (on both legs) | 0.10% (minimum 5 paise per share) |

| Equity Futures (1st leg) Equity Futures (2nd leg) |

0.10% 0.02% |

| Equity Options (on both legs) | 2.5% (minimum Rs. 100 per lot) |

| Currency Futures (1st leg) Currency Futures (2nd leg) |

0.10% (minimum 0.01 paise) Nil |

| Currency Options (1st leg) Currency Options (2nd leg) |

2.5% or a minimum of Rs. 30 per lot Nil |

| Commodity Futures (1st leg) Commodity Futures (2nd leg) |

0.10% Nil |

| Commodity Options | 2.5%, maximum brokerage – Rs. 250 per lot |

Account opening and AMC Charges

| Particulars | Charges |

| Trading & Demat account opening charges | Rs. 0 |

| Trading account annual maintenance charges | Rs. 0 |

| Demat account annual maintenance charges | Up to Rs. 500 depending on the scheme |

Sharekhan Trading Platforms

#1. Sharekhan Trade Tiger

Trade Tiger online trading platform comes in two versions; Trade Tiger Basic for individuals and Trade Tiger Advanced for professional traders.

You can use the advanced charts, stock filter and watchlist to trade stock on a real-time basis.

#2. Sharekhan Mobile App

Sharekhan mobile trading app helps you trade with the help of stock tips, charts, technical indicators and flexible search features.

#4. ICICI Direct Stock Broker Review

ICICI Direct is a full-service stock broker that offers a wide range of banking products along with stock broking facilities.

Through ICICI Direct, you have access to loans (auto, home), insurance, eLocker, NPS, IPO, mutual fund investment, investment advisory and wealth management services.

If you have a savings account with ICICI Direct then you can open a 3-in-1 (Savings, Demat & Trading) account to keep all your accounts under a single umbrella.

Brokerage fees charged by ICICI Direct

ICICI Direct has four brokerage plans

- iSecure Plan

- Prepaid Brokerage Plan

- ICICI Direct Prime

- ICICI Direct Neo Plan

1. Brokerage charges for the i-Secure plan

A variable percentage of brokerage is charged on the basis of quarterly turnover.

| Trading Type | Brokerage Charges |

| Equity Delivery | 0.55% (including buy and sell) |

| Equity Intraday | 0.275% ( the second leg is not charged) |

| Equity Futures | 0.050% plus a flat brokerage of Rs. 50 on the second leg |

| Equity Options | Rs. 95 per lot plus a flat brokerage of Rs. 50 on the second leg |

| Currency/ Commodity Futures | Rs. 20 per order |

| Currency Options | Rs. 20 per order |

The brokerage for Margin and Margin Plus under the i-Secure Plan is 0.050%.

2. Brokerage charges under Prepaid Brokerage plan

| Prepaid value | Delivery Brokerage | Intraday/ Futures | Equity Options | Currency & Commodity F&O |

| Rs. 2,500 | 0.25% | 0.025% | Rs. 35 per lot | Rs. 20 per order |

| Rs. 5.000 | 0.22% | 0.022% | Rs. 30 per lot | Rs. 20 per order |

| Rs. 12,500 | 0.18% | 0.018% | Rs. 25 per lot | Rs. 20 per order |

| Rs. 25,000 | 0.15% | 0.015% | Rs. 20 per lot | Rs. 20 per order |

| Rs. 50,000 | 0.12% | 0.012% | Rs. 15 per lot | Rs. 20 per order |

| Rs. 1,00,000 | 0.07% | 0.007% | Rs. 7 per lot | Rs. 20 per order |

3. Brokerage charges under ICICI Direct Prime plan

| Prime Plan | Scheme validity | Delivery brokerage | Intraday/ Futures | Equity Options | Currency & Commodity F&O |

| Rs. 299 | 365 days | 0.27% | 0.027% | Rs. 40 per lot | Rs. 20 per order |

| Rs. 999 | Lifetime | 0.22% | 0.022% | Rs. 35 per lot | Rs. 20 per order |

| Rs. 1,999 | Lifetime | 0.18% | 0.018% | Rs. 25 per lot | Rs. 20 per order |

| Rs. 2,999 | Lifetime | 0.15% | 0.015% | Rs. 20 per lot | Rs. 20 per order |

| Rs. 3,999 | Lifetime | 0.12% | 0.012% | Rs. 15 per lot | Rs. 20 per order |

| Rs. 4,999 | Lifetime | 0.10% | 0.010% | Rs. 10 per lot | Rs. 20 per order |

4. Brokerage charges under ICICI Direct Neo plan

| Trading Type | Brokerage Charges |

| Neo Plan Subscription fee | Rs. 299 (one time) |

| Equity Intraday | Rs. 20 per order |

| Equity Futures | Rs. 0 per order |

| Equity Options | Rs. 20 per order |

| Commodity F&O | Rs. 20 per order |

| Currency F&O | Rs. 20 per order |

The brokerage in F&O will be charged on both legs under the Neo plan.

Account opening and AMC Charges

You need to have an existing savings bank account with ICICI Bank to open a 3-in-1 (trading + demat + savings) account.

Charges for opening an account are as under

| Particulars | Charges |

| Trading and Demat account opening | Rs. 0 |

| Demat account annual maintenance | Rs. 700 |

ICICI Direct Trading Platforms

ICICI Trade Racer platform is packed with advanced tools like Trend Scanner and “Heat Maps” for analyzing markets and spotting stocks.

The platform gives you fundamental and technical calls while trading (iClick2Gain tool).

#5. Motilal Oswal Stock Broker Review

You get industry-best solid research advisory at Motilal Oswal. They have a repository of 80,000 reports covering markets, economy and 100+ stocks across 45 sectors.

Motilal Oswal’s value-added service includes the facility to invest in gold ETFs, fixed deposits, bonds, IPO, mutual funds and portfolio management (PMS) services.

Brokerage, Admin and AMC fees charged by Motilal Oswal

| Segment | Brokerage |

| Delivery | 0.20% |

| Intraday Trading | 0.02% |

| Options (Equity trading) | Rs. 20 per lot |

| Options (Commodity trading) | Rs. 200 per lot |

| Futures & Options – Currency | Rs. 20 per lot |

AMC Charges – Rs. 999 annually

Motilal Oswal Trading Platforms

#1. MO Investor

MO Investor is for long-term investors with tools like Robo wealth and ACE features that assist with investment strategies.

#2. MO Trader

MO Trader is for advanced traders packed with research reports, 19 screeners, Trade Guide Signal, Option Writer and Option Decoder.

#3. MO Investor App and MO Trader App

MO Investor and MO Trader app helps you trade on your smartphones. They are a miniature version of their corresponding full-fledged trading platforms.

#6. HDFC Securities Review

HDFC Securities is a full-service stockbroking outfit of HDFC Bank. HDFC Securities offers a 3-in-1, 2-in-1 and 1-in-1 account for traders and investors.

The value-added services include research advisory, loan products (auto, home, personal & education), bonds, gold, ETF, insurance and NPS investments. HDFC Securities also offer you the facility to invest in U.S. stocks.

HDFC Securities brokerage charges

HDFC Securities has a percentage based brokerage charge.

| Segment | Brokerage Charges |

| Equity Delivery Trades | 0.50% (for both buy and sell orders) OR a minimum of Rs. 25, OR Maximum of 2.5% on transaction value (both buy and sell) |

| Equity Intraday Trades | 0.05% (for both buy and sell orders) OR a minimum of Rs. 25, OR Maximum of 2.5% on transaction value (both buy and sell) |

| Equity Futures | 0.025% OR a minimum of Rs. 25, OR Maximum of 2.5% on transaction value (both buy and sell) |

| Equity Options | Higher of 1% of the premium amount or Rs.100 per lot (Both Buy & Sell) |

| Currency Futures | Brokerage of Rs. 12 per contract on each side |

| Currency Options | Brokerage of Rs. 10 per contract each side |

| Commodity Futures | 0.020% or minimum Rs.20 per order |

| Commodity Options | Rs.100 per lot |

HDFC Securities account opening and AMC charges

| Type of account | Number of days to open an account |

| 3-in-1 (Savings + Demat + Trading) | 5 days |

| 2-in-1 (Savings + Trading) | 4 days |

| 2-in-1 (Demat + Trading) | 3 days |

| 1-in-1 (only Trading) | 2 days |

There are no account opening charges. But, HDFC Securities levy a charge of Rs. 1999 per year for using their trading software “Pro Terminal”.

Below are the details of charges for opening an account:

| Particulars | Charges |

| Trading & Demat Account Opening charges | Rs. 0 |

| Annual Maintenance charges | Rs. 750 |

In addition to above, if you want to trade in currency derivatives then you need to pay Rs. 250 for activating currency derivatives trading in your account.

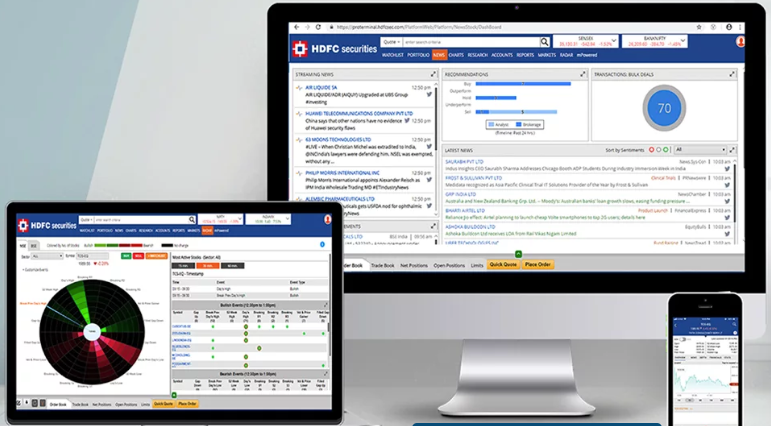

HDFC Securities Trading Platforms

#1. HDFC Pro Terminal

HDFC Pro Terminal works on Ajax-based technology and comes at a nonrefundable fee of Rs 1999 for a period of 1 year.

The trading platform packs Advanced Portfolio Tracker, Stock Screeners, News & Sentiment Analysis and RADAR tool.

#2. HDFC Securities App

The HDFC Securities mobile app helps you track live market data, place trades and track all your investments & portfolio.

#7. SBICap Securities Review

SBICap Securities is backed by the largest public sector bank SBI. The full-stock broker offers a 3-in-1 account.

The services and products you can access are decent research advisory, trade calls, loans against securities, home & auto loans and the facility to invest in NCDs, IPO, OFS and mutual funds.

SBICaps Securities brokerage charges

| Trading Segment | Delivery Trades | Intraday | Intraday |

| First Leg | Second Leg | ||

| Cash Market (Equity) | 0.50% | 0.075% | 0.075% |

| Equity Futures | 0.05% | 0.03% | 0.03% |

| Equity Option | Rs. 100 per lot | Rs. 50 per lot | Rs. 50 per lot |

| Currency Futures | 0.03% | 0.015% | 0.015% |

| Currency Options | Rs. 30 per lot | Rs. 20 per lot | Rs. 20 per lot |

| Commodity Futures | 0.05% | 0.03% | 0.03% |

| Commodity Options | Rs. 100 per lot | Rs. 50 per lot | Rs. 50 per lot |

Account opening and AMC fees charged by SBICap Securities

| Particulars | Fees |

| Account Opening Charges | Rs. 850 |

| Account Maintenance Charges | Rs. 750 |

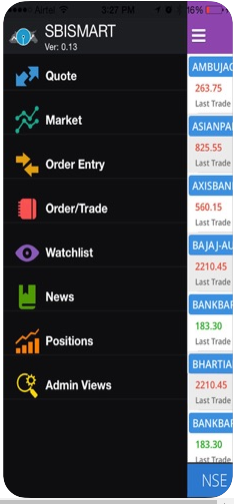

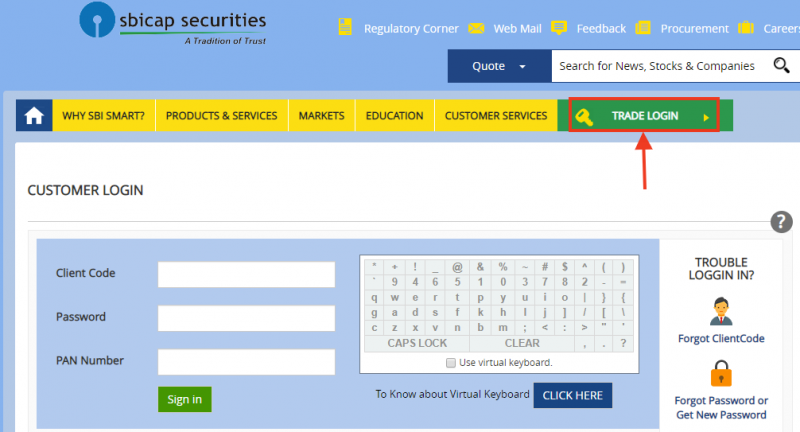

SBICaps Trading Platforms

#1. SBISMART Trading APP

SBICaps Securities offers the SBISmart app for online mobile trading where you can place orders, mark funds, create a market watch, trade and manage funds from the app itself.

#2. SBISMART Xpress

SBISmart Xpress is a desktop trading platform loaded with advanced charting tools, heat maps, live streaming of quotes and auto-refreshing of a trade book.

#3. SBISMART Web trading portal

SBISmart trading platform helps traders get company reports and trading calls. You can use advanced stock screeners, heat maps and stock analysis tools while trading.

#8. Nuvama (former Edelweiss Broking) Review

Nuvama (former Edelweiss broking) has more than two decades of industry presence with 0.3 million of active client base and Rs. 1.5 trillion of client’s assets under management.

You should go with Nuvama if you need guided portfolio investment services. They offer smallcase, IPO, OFS, NCD and portfolio services.

Other services include investment in mutual funds, and insurance products.

Brokerage fees charged by Nuvama Broking

Nuvama has two brokerage plans on two different broking models – the Lite Plan which is like a discount brokerage offered by Zerodha stockbroker.

The Nuvama Elite Plan charges a percentage of turnover, which is similar to other full-service broking.

| Particulars | Nuvama Lite | Nuvama Elite |

| Equity Delivery | Rs. 10 per executed order | 0.30% |

| Equity Intraday | Rs. 10 per executed order | 0.030% |

| Equity Futures | Rs. 10 per executed order | 0.030% |

| Equity Options | Rs. 10 per executed order | Rs. 75 per lot |

| Currency Futures | Rs. 10 per executed order | 0.020% |

| Currency Options | Rs. 10 per executed order | Rs. 20 per lot |

You can switch between Lite and Elite accounts. Nuvama charges Rs. 0 when you switch from Lite to Elite and a fee of Rs. 2500 when you switch from the Elite to the Lite Plan.

Annual Charges collected by Nuvama Broking

| Particulars | Nuvama Lite | Nuvama Elite |

| Account Opening | Rs. 0 | Rs. 0 |

| AMC Charges | First Year – Free Second Year onwards – Rs. 300 |

First Year – Free Second Year onwards – Rs. 500 |

Nuvama Trading Platforms

#1. Terminal X3 (TX3) Trading Platform

Nuvama Terminal X3 helps you trade multiple assets with tools like data analytical tools, 60+ advanced indicators and watchlists.

#2. Nuvama Mobile Trader

Nuvama mobile trader app helps to trade in equity, derivatives, and commodity markets with stock advisory and trading tips.

#9. Axis Direct Review

Axis Direct is an online trading & investment brand of Axis Bank.

The value-added service includes portfolio tracker & management, advisory services both for mutual funds and stock, ETF, IPO, general insurance and tax planning.

Axis Direct Brokerage plans

Axis Direct has 3 brokerage plans. The charges under each plan are mentioned below.

| Plans | Complimentary Delivery Turnover (CDT) | Validity period | Account opening charges | Value Added Subscription fee |

| Fixed Plan | N.A | N.A. | Rs 499 | Rs. 0 |

| Investment Plus Plan | Rs. 3 Lakhs (buy + sell) | 12 months | NIL | Rs. 1,500 |

| Now or Never Plan | Rs. 12 Lakhs (buy + sell) | 10 years | NIL | Rs. 5,555 |

| Premium Investment Plan | Rs. 25 Lakhs (buy + sell) | 1 year | NIL | Rs. 10,000 |

Brokerage Rates

| Plans | Fixed Plan | Investment Plus Plan | Now or Never Plan | Premium Investment Plan |

| Equity Delivery (each leg) | 0.50% | 0.35% | 0.20% | 0.10% |

| Equity Intraday (each leg) | 0.05% | 0.035% | 0.03% | 0.01% |

| Futures (each leg) | 0.05% | 0.035% | 0.02% | 0.01% |

| Options | Rs. 10 per order | Rs. 10 per order | Rs. 10 per order | Rs. 10 per order |

Annual charges at Axis Direct

| Particulars | Fees |

| 3-in-1 Account Opening Charges | Fixed Plan – Rs. 999 Investment Plus Plan – Rs. 0 Now or Never Plan – Rs. 0 |

| Annual Maintenance Charges | For Axis Bank Customer: First Year: Free Second Year Onwards: Rs. 750 For Non-Axis Bank Customer: First Year onwards: Rs. 2,500 |

Trading Platforms of Axis Direct

#1. Axis Direct Trade

Axis Direct Trade helps you create multiple customized watch lists, streaming live quotes, market watch, check open positions, pending order status, and MTM values.

#2. Axis Web Trading Platform

Axis Web is an HTML browser-based trading platform that offers a clutter-free “card view” of important trade and news that helps you grasp information at a glance.

The platform gives you access to customized filters, alerts and notifications so that you do not miss any price, news or trade information.

#3. Axis Mobile Trading App

Axis Direct mobile trading app helps you trade-in equity and derivatives only. Apart from that you can view live quotes, charts and create watchlists.

#10. Ventura Securities Review

Ventura Securities started stockbroking in 1994 and offers hand-holding, stock advisory and trading tips while trading and investing.

The value-added services include investment in IPO, mutual funds, fixed income securities, NPS and depository services.

Ventura Securities brokerage plans

Ventura Securities charges software (trading platform) access fees. The brokerage rates for different amounts of access charge is in the table below.

The amount of software access fees, which is refundable, is lower of

- To the extent of the brokerage generated

- The maximum refundable amount as indicated in the table below

Brokerage Plan Types

| Access Charge (in Rs.) |

Mobile Markets | Max Refund Amt (in Rs.) |

Period | Delivery | Intraday (Equity & Equity Futures) Charged one leg only |

Equity Options Rs. per lot |

| 1000 | No | 1000 | 1 year | 0.45% | 0.05% | Rs. 100 |

| 2000 | No | 2000 | 1 year | 0.35% | 0.04% | Rs. 100 |

| 3500 | No | 3500 | 1 year | 0.20% | 0.03% | Rs. 100 |

| 5000 | No | 5000 | 1 year | 0.17% | 0.025% | Rs. 100 |

| 7500 | No | 7500 | 1 year | 0.15% | 0.02% | Rs. 100 |

| 9999 | Yes | 9999 | 1 year | 0.15% | 0.02% | Rs. 100 |

| 10,000 | Yes | 10,000 | 6 months | 0.15% | 0.015% | Rs. 100 |

| 18,000 | Yes | 18,000 | 1 year | 0.15% | 0.015% | Rs. 100 |

| 15,000 | Yes | 15,000 | 6 months | 0.13% | 0.0125% | Rs. 100 |

| 25,000 | Yes | 25,000 | 1 year | 0.13% | 0.0125% | Rs. 100 |

| 20,000 | Yes | 20,000 | 6 months | 0.10% | 0.01% | Rs. 100 |

| 30,000 | Yes | 30,000 | 1 year | 0.10% | 0.01% | Rs. 100 |

| 40,000 | Yes | 43,000 | 1 year | 0.10% | 0.01% | Rs. 70 |

| 50,000 | Yes | 55,000 | 1 year | 0.10% | 0.01% | Rs. 60 |

| 72,000 | Yes | 80,000 | 1 year | 0.10% | 0.01% | Rs. 50 |

Currency Derivatives – Rs. 20 per lot on a single leg of the transaction.

Commodity Trading Brokerage

| Yearly Software Access Charge (in Rs.) | Commodity Futures (brokerage slabs – both sides) | Commodity Options |

| 1000 | 0.0200% | Rs. 100 per lot |

| 3500 | 0.0150% | Rs. 100 per lot |

| 5000 | 0.0100% | Rs. 100 per lot |

| 7500 | 0.0090% | Rs. 100 per lot |

| 10,000 | 0.0080% | Rs. 100 per lot |

| 15,000 | 0.0075% | Rs. 100 per lot |

| 20,000 | 0.0070% | Rs. 100 per lot |

| 25,000 | 0.0065% | Rs. 100 per lot |

| 30,000 | 0.0060% | Rs. 100 per lot |

| 40,000 | 0.0055% | Rs. 100 per lot |

| 50,000 | 0.0050% | Rs. 100 per lot |

| 75,000 | 0.0040% | Rs. 100 per lot |

| 1,00,000 | 0.0030% | Rs. 100 per lot |

Account opening and AMC charges at Ventura Securities

| Particulars | Plan A | Plan B | Plan C |

| With POA | Without POA | With POA | |

| Trading Account Opening | Nil | Nil | Nil |

| Demat Account Opening (Refundable Deposit) | Nil | Nil | Rs. 3000 |

| AMC Charges | Nil | Nil | Nil |

Ventura Trading Platforms

#1. Ventura Pointer

Ventura Pointer gives access to live market watch, market summary and exchange messages. You can create a watchlist and customize the trading window.

But you need to use the dropdown menus and function keys to access order book and trade.

#2. Ventura Wealth & Ventura Commodities Mobile Apps

Ventura Securities has two apps – Ventura Wealth app for trading in equity, equity derivatives, and currency derivatives.

Whereas, Ventura Commodities helps you trade only in commodities.

#11. Religare Broking Review

Religare Broking is a subsidiary of Religare Group offering stockbroking services to 10 Lakhs clients. However, their value-added services are limited to research advisory, investment in mutual funds, and NPS.

Religare Brokerage charges

| Trading Segment | Brokerage Charges |

| Equity Delivery | Maximum – 2.5% Minimum – 25 paise |

| Equity Intraday | Maximum – 2.5% Minimum – 25 paise |

| Equity Futures | Maximum – 2.5% / Rs. 100 per lot |

| Equity Options | Maximum – 2.5% / Rs. 100 per lot |

| Currency Futures & Options | Maximum – 2.5% / Rs. 100 per lot |

| Commodity Futures (BSE/ MCX/ NCDEX) | Maximum 2.5% of the premium amount |

| Commodity Options (MCX) | Maximum 2.5% of the premium amount or Rs. 250 per lot, whichever is higher |

| Commodity Options (BSE/ NCDEX) | Maximum 2.5% of the premium amount or Rs. 100 per lot, whichever is higher |

Religare Annual fee and Account opening charges

| Particulars | Charges |

| Demat Account Opening Charges | Rs. 0 |

| Trading Account Opening Charges | Rs. 0 |

| Annual Maintenance Charges | Normal AMC Plan – Rs. 400 per annum. Bandhan AMC Plan – NIL AMC, if you keep a refundable interest free security deposit of Rs. 2500. Bima AMC Plan – NIL AMC, if you pay a non-refundable one-time subscription fee of Rs. 1,111. |

| Account Processing Fee | Rs. 500 |

Religare charges Rs. 999 for EXE. based DIET trading platform.

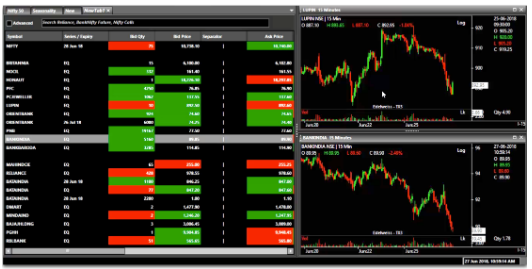

Religare Trading platform

#1. Religare Web Portal

The Religare web portal can be accessed on PC, mobile and laptop that has an internet connection. The platform helps you trade-in equity, F&O, currency and commodities.

#2. Religare DIET ODIN

Religare ODIN (Open Dealer Integrated Network) is powerful yet stable and is still in use with few of the older broking firms.

DIET ODIN platform integrates back office, DP and risk management services which makes it fast and reliable.

#3. Religare Dynami

Religare Dynami is a mobile app-based platform that gives you a trading notification, detailed investment ideas with a facility to place orders from the research section.

You can create personalized watchlists, do instant fund transfer and view real-time charts on the app.

Factors to Consider Before Opening Account With Full-Service Broker

#1. Your Investment & Trading Needs

Every individual has different financial goals and needs. Some may have short-term needs that can be fulfilled by trading whereas others may have long-term goals of building a wealth corpus who may like value investment.

You may be in need of other services simultaneously like mutual fund investments, tax planning, loan (auto & home), NPS, insurance, smallcases, portfolio and wealth management services.

So, before you pick your full-service broker you need to check your investment requirements and then find a broker who fulfills them.

#2. Existing Financial Relationship

A lot of banks (both public and private) offer full-service broking services through their subsidiaries.

So, if you already have an existing banking relationship, then it makes sense for you to enquire whether they can provide you with a trading facility.

This way you will not need to open accounts (demat, trading & bank) at different companies but can maintain all your financial transactions with a single entity.

#3. Brokerage Charges

Almost all of the full-service brokers will charge you a percentage-based brokerage fee on the trade volume (share price x number of shares).

You need to check your investment needs and the money that you can pay as brokerage fees. The value proposition will be to pay in line with the investment support you need.

If you want to save on brokerage charges then you can open an account with discount brokers like Zerodha charges a flat Rs 20 per trade on intraday, FNO and zero on stock delivery.

#4. Trading Facilities

Finally, you need to check the trading tools offered. The trading facilities need to help you transfer funds, trade without hiccups and manage your money and stock portfolio efficiently.

The platform should help in market study and assist in strategy building.

Moreover, the platform should be available across different kinds of devices like PC, laptops & smartphones and should be easy to use.

Conclusion

Full-service stockbrokers can guide you in wealth building and fruitful investing. But, you need to know your trading needs first.

Open an account with Angel Broking if you are looking for a low cost full-service broker with research advisory and trading tips. You need to pay a flat brokerage of Rs. 20 per trade with Angel Broking. Their other value-added services are limited.

Motilal Oswal suits long-term investors who want to build a solid portfolio (wealth) based on solid research expertise. They have a dedicated in-house research team to back all your investment needs.