Latest Zerodha Brokerage Charges 2024

Latest Zerodha Brokerage Charges 2024

Zerodha charges one of the lowest brokerage fees of flat Rs. 20 for intraday trading in India.

Cost-wise, Zerodha is suited to the investment and trading requirements of volume intraday traders and beginner traders.

- What are Zerodha Charges?

- Zerodha Charges List – of All Charges and Taxes

- Zerodha Brokerage Charges

- Zerodha Other Charges List

- Zerodha DP Charges

- Zerodha Charges for Cancelled Orders

- Zerodha Fund Transfer Charges

- Zerodha Fund Withdrawal Charges

- STT Charges in Zerodha

- Zerodha Charges for GTT

- Zerodha Charges For BTST

- Zerodha Charges For Auto-square Off

- Zerodha Charges for Coin

- Zerodha Smallcase Charges

- Zerodha Charges for Optional Value Added Services

- Zerodha Charges For NRI Trading and Demat Account

- What to do next?

- Zerodha Charges – Frequently Asked Questions

What are Zerodha Charges?

Zerodha charges are the fees that you’ll have to pay when you use their platform to trade in the stock market.

There are several different types of charges that you’ll encounter, so let’s go over each one in detail.

I have listed all the Zerodha charges in this article that you need to know.

Zerodha Charges List – of All Charges and Taxes

Zerodha Account Opening Charges

Rs. 200 is all you need to pay for an online Demat account opening. The trading account is opened simultaneously for free.

With both the trading and demat account in place, you can do intraday, equity F&O and currency F&O trading.

However, you need to pay an extra Rs. 100 if you want an MCX commodity account.

Charges for Offline Account Opening –

| Equity trading and demat account | ₹400 |

| Equity trading, demat and commodity account | ₹600 |

Zerodha Annual AMC (Account Maintenance Charges)

You need to pay Rs 75 per quarter for AMC charges, a total of Rs 300 per year.

- Zerodha AMC Charges – Rs 300

You can consider a Upstox account only if you are looking for a free Demat account with zero AMC charges. But Zerodha is better than Upstox in terms of delivery charges, customer support, and better trading platforms.

Zerodha Brokerage Charges

Brokerage is the fee that you pay to Zerodha for every trade that you make on their platform.

Zerodha charges a flat fee of ₹20 per trade, regardless of the size of the trade.

You only pay ₹20 in brokerage charges whether you’re buying or selling ₹1,000 worth of stock or ₹1,00,000 worth of stock which is not the case with full-service brokers.

For example, ICICI Direct charge 0.55% on delivery and 0.275% on intraday trades under the I-Square plan. You would pay a brokerage of Rs 275 on trading 1 lakh worth of stocks.

| Trading Segment | Charges |

| Zerodha Equity Delivery | Rs. 0 |

| Zerodha Equity Intraday | Rs. 20 or 0.03% per executed order whichever is lower |

| Zerodha Equity Futures | Rs. 20 or 0.03% per executed order whichever is lower |

| Zerodha Equity Options | Flat Rs. 20 per executed order |

| Zerodha Currency Futures | Rs. 20 or 0.03% per executed order whichever is lower |

| Zerodha Currency Options | Rs. 20 per executed order |

| Zerodha Commodity Futures | Rs. 20 or 0.03% per executed order whichever is lower |

| Zerodha Commodity Options | Rs. 20 per executed order |

Zerodha Delivery Charges

Equity delivery in Zerodha is completely free.

Zerodha Intraday Charges

Zerodha’s intraday charge is lower of Rs. 20 or 0.03% per executed order irrespective of the trading volume. This helps both high-volume traders as well as small traders.

For example, if you trade for Rs 10,000 then Zerodha will charge Rs 3 for intraday trading, not Rs 20.

But if you place a trade for 10,00,000 then a fixed charge of Rs 20 will be charged.

Zerodha F&O Charges

Here are the details of Zerodha futures and option trading charges.

| Trading Segment | Charges |

| Equity Futures | Rs. 20 or 0.03% per executed order whichever is lower |

| Equity Options | Flat Rs. 20 per executed order |

| Currency FNO | Rs. 20 or 0.03% per executed order whichever is lower |

| Commodity FNO | Rs. 20 or 0.03% per executed order whichever is lower |

Note – ₹40 per executed order brokerage will be charged instead of ₹20 while placing an F&O order if your account has a negative balance.

In case, you are pledging shares to get the collateral margin to trade in the F&O segment then –

Pledging Charges – Rs. 30 per pledge request

Government Taxes and Other Zerodha Charges

Transaction Charges

You’ll need to pay a small amount of transaction charges on every trade that you make in addition to the brokerage charges above.

Transaction charges are set by NSE & BSE and are calculated on the total traded value and are rounded off to the nearest paisa.

| NSE transaction charges | 0.00345% |

| BSE transaction charges | 0.00375% |

STT (Securities Transaction Tax)

STT is levied by the government and is calculated as a percentage of the total traded value of the security.

For equity delivery, STT is charged at 0.1% of the total traded value on buy & sell.

For equity intraday, STT is charged at 0.025% on the sell side only.

GST (Goods and Services Tax)

GST is levied by the government on the services provided by the broker.

18% GST needs to be paid on the brokerage fee, SEBI charges and transaction fee.

SEBI (Securities and Exchange Board of India) Charges

Every broker has to pay a fee to SEBI for every trade that they execute on behalf of their clients.

Zerodha charges a fee of ₹10 per crore traded as SEBI charges.

Stamp Duty

Stamp duty is a tax levied by the state government on the transfer of securities. The rate of stamp duty varies from state to state.

Zerodha collects 0.015% as stamp duty on equity delivery and 0.003% as stamp duty on intraday trades on the buy side.

DP (Depository Participant) Charges

DP charges are levied by the CDSL / NSDL whenever you sell shares from your demat account.

Zerodha charges a fee of ₹13.50 per scrip per day for debiting securities from your demat account.

How are these charges calculated?

Total cost of trade = (Total trade value x Brokerage) + Transaction charges + STT + GST + SEBI charges + Stamp duty

For example, if you buy intraday ₹1,00,000 worth of stock on Zerodha, then the total charges will be =

Brokerage = (100,000 * 0.0003) or Rs. 20, in this case it will be Rs. 20

Transaction charge = 100,000×0.00345% = Rs. 3.45

STT = Rs. 0 (being buy side)

SEBI Charges = 10 per crore + GST on Rs. 1Lac = Rs 0.12

GST charges = 18% of (brokerage +SEBI charges + transaction charges) which is 0.18 x ( 20+0.12+3.45) = 4.22

Stamp duty charges = 0.003% on Rs 1 Lac = Rs. 3

Total = 20+3.45+0+0.12+4.22+3 = ₹30.79

You need to pay Rs. 20 in brokerage plus Rs. 10.79 in taxes.

Rs. 30.79 is what you pay to take an intraday buy trade worth Rs. 1 Lac

Zerodha Call and Trade Charges

Rs. 50 per order for placing an order using Zerodha’s Dealer desk, Customer care or RMS team.

Call & Trade charges include –

- successfully placed buy/sell order

- executed orders

- rejected orders

- cancelled orders

Note – If you called Zerodha to place an order and it got canceled or rejected then there will be no cancellation charges but you need to pay Rs. 50 as call and trade charges.

Zerodha Mutual Funds Charges

Zerodha charges Rs. 0 for investing in direct mutual funds of any company.

Zerodha Charges Calculator

Helps get a prior estimation of various charges.

Link to Zerodha Charges Calculator.

Rs. 75 account maintenance is charged per quarter starting from the account opening date.

Zerodha Other Charges List

Zerodha DP Charges

DP charges are applicable whenever you sell shares from your Demat account.

Rs. 13.50 per day per scrip for the shares sold. Here the number of shares doesn’t matter.

Only Rs. 13.50 is charged.

Doesn’t matter whether you sell 1 share of SBI or 1000 shares.

But if you sold 1 share of SBI and 1 share of Reliance then 13.50 +13.50 = Rs. 27 as DP charges need to be paid.

Zerodha Charges for Cancelled Orders

Zerodha doesn’t charge for canceled orders.

Cancellation can be due to –

- Canceling orders manually

- Auto-canceled by the system

- Order rejected for short of funds or any reason

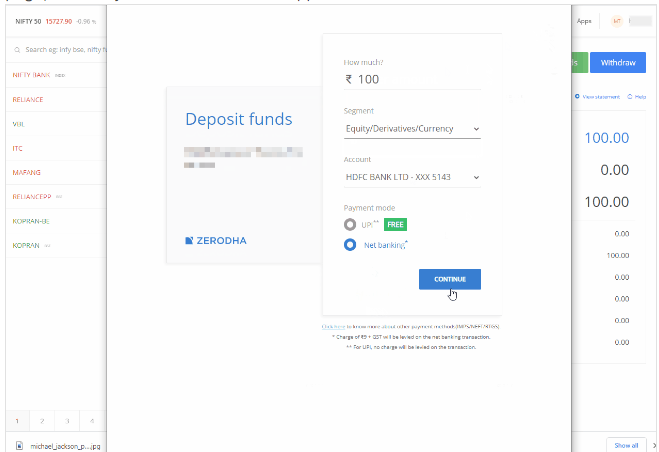

Zerodha Fund Transfer Charges

Zerodha provides multiple options to add funds to your Zerodha trading account which includes UPI, IMPS and Net banking options.

UPI & IMPS options are free.

But you need to pay Rs 9 per transaction if you choose to add funds through net banking.

| Mode used to add funds | Payment Gateway Charges |

| UPI | Rs. 0 |

| IMPS | Rs. 0 |

| Net banking (internet banking) | Rs. 9 |

Funds become immediately available for trading.

Zerodha Fund Withdrawal Charges

Zerodha doesn’t charge any fee for withdrawing funds from your trading to your bank account.

Zerodha fund withdrawal charges – Rs 0

STT Charges in Zerodha

Securities Transaction Tax or STT charge is a direct tax charged on the purchase and sale of securities through Zerodha.

STT charge is paid to the central government of India.

| Zerodha STT Charges | Amount |

| Equity delivery | 0.1% on buy & sell |

| Equity intraday | 0.025% on the sell side only |

| Equity futures | 0.01% on sell-side |

| Commodity futures | 0.01% on sell side (Non-Agri) |

| Commodity options | 0.05% on sell-side |

| Currency F&O | No STT charges applied |

Zerodha Charges for GTT

Zerodha charges Rs. 0 for using GTT.

Good Till Trigger (GTT) allows you to set certain trigger (price) conditions leading to buying/ selling of shares at a particular price.

When the conditions are met, a limit order is placed on BSE/ NSE.

Normal brokerage is charged once the buy/sell order is placed after the GTT is triggered.

GTT can be used only for

- CNC type orders in the Equity Cash segment on NSE & BSE

- NRML type orders in the Equity Derivatives segment on NSE.

Cash and Carry (CNC)- is used for delivery trades in equity.

Normal (NRML) – is a term for overnight trading of futures and options contracts. NRML type orders in the derivatives segment allow you to carry your position till the expiry of the F&O contract.

Zerodha Charges For BTST

There is NIL (Rs. 0) brokerage on BTST trades because the CNC product type is used which represent equity delivery.

But there is a DP charge of ₹13 per stock per day when you sell the next day.

Zerodha Charges For Auto-square Off

Auto square-off is classified as a “Call and trade” facility by Zerodha.

Rs. 50 per order is charged when the system auto-squares off all open intraday positions at or after the cut-off time.

| Segment | Equity intraday | Equity F&O | Currency F&O | Commodity F&O |

| Cut-off time | 3.20 pm | 3.25 pm | 4.45 pm | 25 mins before close |

Zerodha Charges for Coin

| Security Type | Charges |

| Mutual funds | Free |

| G-sec,T-bills & SDLs | 0.06% on total investment value |

Zerodha Smallcase Charges

You need to pay a flat fee of Rs 100 per transaction for Smallcase fee.

Rs. 10 in case you want to use SIP route for smallcase investment.

Zerodha Charges for Optional Value Added Services

| Services | Bill Frequency | Charges in Rs. |

| StockReports+ | Monthly / Bi-annually / Annually | 150/ 810/ 1440 |

| Screener | Monthly / Quarterly / Bi-annually / Annually | 100/ 285/ 540/ 960 |

| Smallcase | Per transaction | 100 |

| Sensibull | Monthly | Free: 0 Lite: 800 Pro: 1300 |

| Streak | Monthly | Regular: 690 Ultimate: 1400 |

| Kite Connect | Monthly | Connect: 2000 Historical: 2000 |

Zerodha Charges For NRI Trading and Demat Account

NRI Account Opening Charges

NRI trading and demat account can only be opened offline.

NRI’s have an option to open a PIS account or a Non-PIS account.

Account opening fees – Rs. 500.

AMC charges – Rs. 125 per quarter (Rs. 500 annually).

NRI Brokerage Charges for Equity

| PIS trading and demat account | Non-PIS trading and demat account |

| Lower of 0.5% or ₹200 per executed order | Lower of 0.5% or ₹100 per executed order |

| Banks charge up to Rs 300 per contract note (per day of trading) for handling TDS. | NIL |

| Banks charge an additional AMC of up to Rs 1500 per year in addition to demat AMC of Rs. 500. | Only demat AMC of Rs. 500 applies |

NRI Brokerage Charges for F&O

NRIs can trade in F&O only through a custodial account. Orbis Financial Corporation Limited (SEBI registered) is Zerodha’s custodian partner.

Zerodha brokerage charges for F&O – ₹100 per order.

Orbis additionally charges ₹150 per crore for futures and ₹1500 per crore for options as clearing charges on a monthly basis.

What to do next?

Zerodha is a best discount broker for both beginner and professional DIY traders.

If you do your own research then on Rs. 5000 per month (10 trades x Rs. 20 brokerage x 25 days) you can do over a crore volume of share trading.

Zerodha Charges – Frequently Asked Questions

Yes, Zerodha is a great platform for beginners. They offer a user-friendly interface and low fees, making it easy for anyone to get started with investing in the stock market.

No, there are no hidden charges with Zerodha. All of the charges are clearly listed on their website and are calculated in real-time when you make a trade.

The best way to avoid paying high fees with Zerodha is to keep your trades small. Since the brokerage fee is a flat fee of ₹20 per trade, it makes more sense to make multiple small trades rather than one large trade.

In addition to their low fees, Zerodha also offers a range of other features, including a mobile app, trading tools, educational resources, and more.