How to Invest in Index Funds in India (Nifty & Sensex)

How to Invest in Index Funds in India (Nifty & Sensex)

90% of mutual funds follow an active investing style.

Under active investing – the fund manager does extensive research to find stocks that will beat the market returns.

Remaining 10% are – Index funds.

Index funds follow a completely different – “Passive investment” style.

Index funds copy the movement of a particular index. The underlying index can be Nifty 50, Sensex 30, Nifty 100 or Nifty Next 50.

The index fund’s portfolio consists of the same stocks that are included in the underlying index, in the exact same proportion.

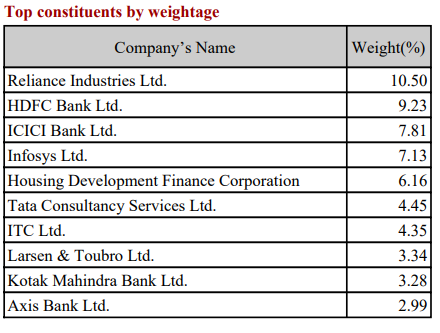

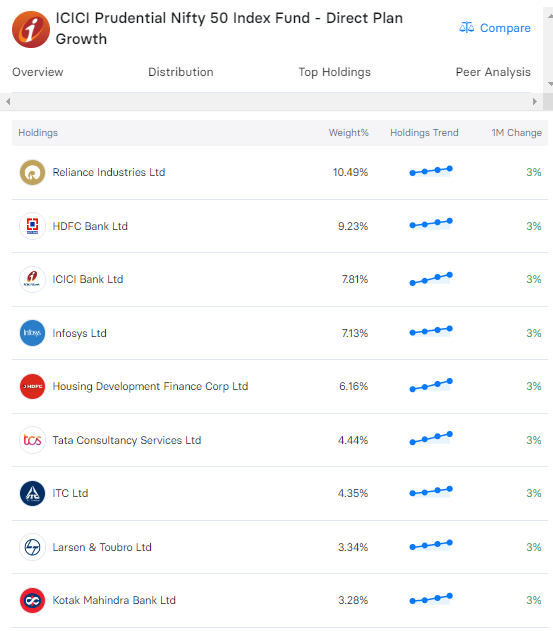

For example, below is the weight of the top 10 companies in Nifty 50.

Index funds put all of the money in the same stocks that the index tracks. The amount of money invested in each stock is also in the same proportion as the index.

You can see that the ICICI Prudential Nifty Index Fund portfolio has shares investment in the same proportion (weights) as Nifty 50.

Nifty or Sensex is the common benchmark that most index fund follows.

A few other popular indexes are

- Nifty Bank index

- Nifty Midcap

- Nifty 100

- Nifty Smallcap

- Nifty Next 50

Will Index Fund Suit Your Investment Style

If you want to invest in equities but do not want to expose yourself to the risks associated with wrong selection of an individual stock then you can invest in Nifty or Sensex index fund.

Index funds minimise portfolio risk by investing in multiple stocks across different sectors.

The best part is that your portfolio is protected from the underperformance of any single stock because some other stocks in the index will be performing well. This way, you can expect a more stable return on your investment if the overall market is going up.

And that’s not all! Unlike actively managed funds, index funds don’t come with the added risk of the wrong selection of stocks by the fund managers.

If you’re looking for high risk high return funds then you may research equity funds that may perform better than the overall market.

Different types of index funds available in India

#1. Nifty Index Funds – Nifty index funds track the performance of the Nifty 50 index. This is similar to investing in Nifty, which consists of the top 50 companies listed on the National Stock Exchange.

#2. Sensex Index Funds – Sensex index funds track the performance of the Sensex 30. Here you invest in the top 30 companies listed on the Bombay Stock Exchange.

#3. Sectoral Index Funds – Sectoral index funds track the performance of a specific sector, such as banking, technology, or healthcare.

For example, the Motilal Oswal Nifty Bank Index Fund is a sectoral index fund that is based on the Nifty Bank index.

Benefits of investing in Index Funds

- Index Funds are passively managed

- Index funds have a low expense ratio

- The funds are free from individual human bias

Difference Between Index Fund and Mutual Fund

| Particulars | Index Fund | Mutual Fund |

| Investment Style | Passive fund management | Decided by fund manager |

| Expense Ratio | Low 0.10% to 0.50% | High upto 2% |

| Objective | Replicate index performance | Outperform the benchmark |

| Investment portfolio | Fixed | Keeps changing |

| Returns | Almost the Same as Market Returns | Expected to Beat Market Returns |

How to Invest in Nifty 50 (Index Funds) for Long-Term

Low expense ratios make index funds a better option for investors who want to accumulate wealth in the long term.

Low expense ratio is because index funds follow a fixed investment portfolio in stocks similar to indices.

List of Top Index Funds in India

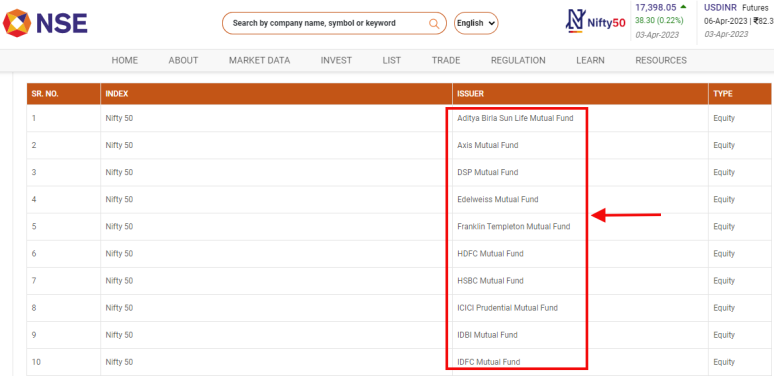

Index funds in India available on the NSE website as under

Top 5 Index Funds in India at present are

- Tata Nifty 50 Index Fund -Direct Plan

- UTI Nifty 50 Index Fund

- Nippon India Index Fund – Nifty 50 Plan

- ICICI Prudential Nifty 50 Index Fund

- BANDHAN Nifty 50 Index Fund

The above list is based on the past 5 years annualized returns.

Step 1 – Choose an Investment Platform

Best index fund investment platforms in India are

- Zerodha Coin

- Groww

- Scripbox

- FundsIndia

- IND Money

If you already have a demat & trading account then chances are that your broker also provides investment in the index funds.

Stockbrokers like Zerodha, Motilal Oswal, and ICICI Direct through their platform offer direct investment in index fund facility.

Step 2 – Pick the Right Index Fund

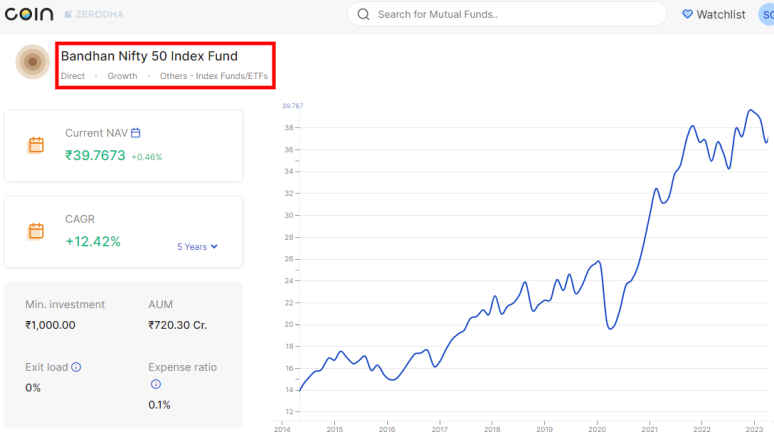

Comparison of the present top 5 index fund is below

| Index Fund | 5 Year Returns | Expense Ratio | AUM |

| Bandhan Nifty 50 Index Fund | 12.42% | 0.10 | 720.30 Cr |

| UTI Nifty 50 Index Fund | 12.28% | 0.20 | 9965.39 Cr |

| Tata Nifty 50 Index Fund | 12.27% | 0.16 | 385.64 Cr |

| ICICI Prudential Nifty 50 Index Fund | 12.20% | 0.16 | 4176.69 Cr |

| Nippon India Index Fund | 12.19% | 0.20 | 753.55 Cr |

At present “Bandhan Nifty 50 Index fund” has the highest 12.42% returns and lowest 0.10 expense ratio and decent fund size of 720 Crores.

Step 3 – Index Fund Investment

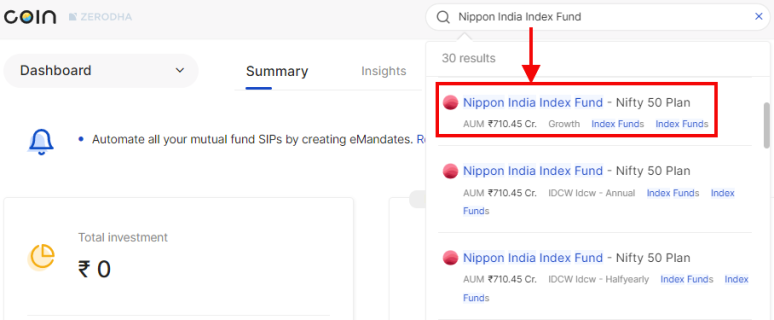

I am using Zerodha Coin platform to show you how to invest in the index fund but you can use any mutual fund investment platform.

Type the name of the index fund on the top right search option.

Select the Nifty 50 plan Index Fund as shown below.

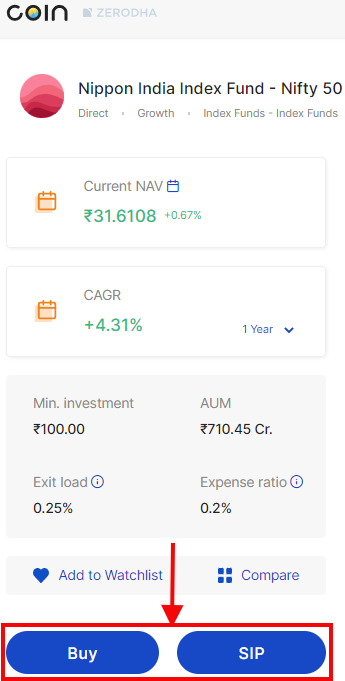

You have the option to invest by making a single Lumpsum payment or do a monthly SIP.

Monthly SIP is better for salaried people who want to invest small amount every month. Lumpsum investment is better for small business owners who expect 1-2 big money inflows in a year.

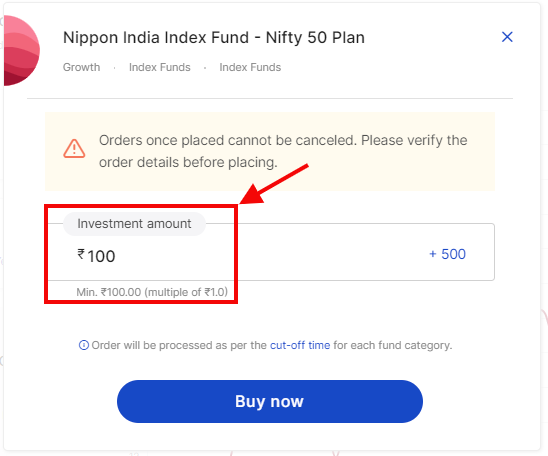

Click the Buy option and a pop-up form will appear as under

You will be directed to the payment page when you click the “Buy now” button. Follow the instruction and provide OTP to transfer funds.

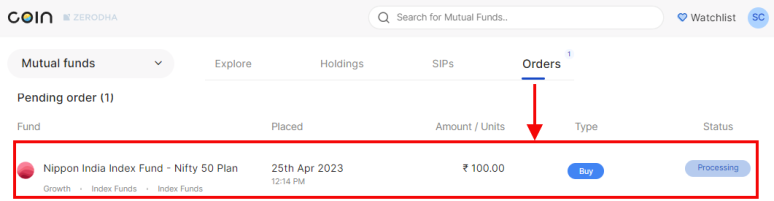

Once you have completed the payment, the details of your order will be as shown below

The units of the index fund purchased will be credited into your account the next day (T+1 day) evening after 7 PM.

How to Invest in Index Funds in India Through Zerodha Coin

To invest in index funds through Zerodha Coin, follow the below given steps

#1. Open a Zerodha Trading and Demat Account

Click here to go to the Zerodha website for account opening.

Enter your phone number, provide email ID, name to allow account opening.

#2. Complete the KYC Process

Provide your PAN & Aadhar number as identity and address proof. Zerodha will guide you through the process and provide you the required instructions.

#3. Activate Zerodha Coin

Login using your Zerodha User ID and password. This will activate your Zerodha Coin platform.

You can invest in index mutual funds only if your Zerodha Coin account is activated.

#4. Fund Your Zerodha Account

Transfer funds into your Zerodha Coin account for buying index funds using UPI or through net banking. 100 rupees is the minimum investment amount in index funds.

#5. Explore Available Index Funds

There is a list of all the available index funds on the Coin Dashboard. You can explore fund composition, review historical performance and check expense ratio by clicking the fund.

#6. Place a Buy Order

Specify the amount you wish to invest in the index fund and click on the “Buy” option.

You will receive confirmation once your order is executed. The index fund units you purchased will be allocated to your demat account.

You can check the below video for index fund investing on Zerodha Coin.

The steps are more or less similar in case you are using a different platform like Groww, Paytm, Kuvera or Scripbox.

Drawbacks of Investing in Index Funds

#1. Risk of Tracking Error

Tracking Error arises due to minor differences in the composition of the index fund. Tracking errors can range from 0.03% to 0.16%.

Index share weight changes and corporate actions like bonus share issues cause tracking errors. Tracking error results in a slightly different return when compared to that of the benchmark index.

#2. Index Fund Doesn’t Offer Flexibility to the Fund Manager

An index fund has to be fully invested at all points in time. Even in extreme market upsides & downsides.

The index fund manager has no flexibility to hold cash in a bearish market or increase allocation in high beta stocks in a bull market.

#3. Index Funds are Likely to Underperform

India has a developing stock market. This gives an opportunity to find undervalued stock. Active mutual funds invests in such undervalued stocks to generate higher returns by taking additional risks.

In comparison to that – index funds simply invest in the underlying benchmark. The returns generated is similar to the indices.

Investors looking for high-risk high return investments should avoid index funds.

Tax Implications of Investing in an Index Fund

Index funds are subject to capital gains tax when you sell your units.

Short-term capital gains (less than 12 months holding) are taxed according to the normal slab rate.

Whereas long-term capital gains (more than 12 months of holding) is taxed at the rate of 10% for capital gains over Rs. 1 Lac.

FAQs

The main advantage of investing in an index fund over an actively managed fund is the low fees.

Actively managed funds require a fund manager to research and select stocks, resulting in higher fees.

Index funds, on the other hand, track a specific index and do not require active management which resulting in lower fees.

It’s a good idea to review your index fund portfolio once a year to ensure that it aligns with your investment goals.

If your investment goals or risk tolerance change, you may need to make adjustments to your portfolio.

You can monitor the performance of your index fund investment by tracking the performance of the underlying index.

Most brokerage platforms provide comparison charts that enable you to track the performance of your investments in real time.

Yes, index funds are a great investment option for beginners who are just starting with investing and don’t want to bother about stock research.

Index fund provide diversification, low fees, and do not require extensive research or market timing.

You can use an investment platform like Groww, Scripbox & Kuvera or a stock brokerage account like Zerodha Coin to buy an India index fund.

Presently, Bandhan Nifty 50 Index Fund is the best index fund in India.

The ranking is based on the last 5 year’s annualized returns.

But remember that – the ranking of the best index funds in India keeps on changing.

You can use Zerodha Coin to invest directly in index funds.

Another option is to visit the Mutual fund website directly, create a folio and invest in an index fund.

The main risk of investing in an index fund is market risk. Index funds track a specific index, their performance is closely tied to the performance of the overall market.

If the market experiences a downturn, the value of your index fund investment will decline.

Final Thoughts

Index funds offer you market returns without taking too much risk as in case of an individual stock investment.

Index funds investment provide you exposure to a diversified portfolio of stocks while keeping your expense ratio low.

Beginners can start investing in an index fund even with Rs. 100 every month. You just need to stay invested for a long-term period for successful index fund investment.