How to Invest in Gold in India: 2024

How to Invest in Gold in India: 2024

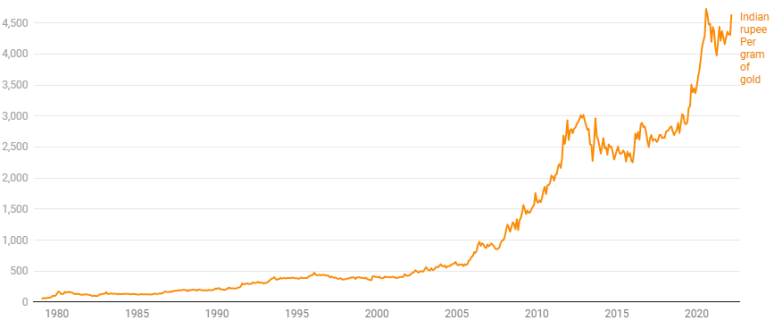

Gold price has skyrocketed from Rs. 90 per gram in 1979 to Rs. 6000 per gram in 2023. If you do the math, then your returns are massive

Rs. 6000 – Rs. 90 = Rs. 5910

Rs. 5910 / 90 x 100 = 6,567% returns over the 45 years of investment.

Physical gold form and Digital gold form are the two ways to invest in gold in India.

Physical gold investment is raw gold, buying gold jewellery, coins, and gold bars.

Digital Gold investment includes investing in gold ETFs & gold mutual funds, gold bonds and through online platforms. Each gold investing option has its own set of pros and cons.

In the article, we’ll discuss the pros and cons, aspects like pricing, purity, taxation, and storage options to help you make informed gold investments decision.

- Physical Gold Vs Digital Gold Investment

- How Much Percentage of Your Total Investment Should be Gold

- How to Invest in Physical Gold in India

- Taxation on Gold in India

- How Much Physical Gold Can You Keep at Home

- How to Invest in Digital Gold in India

- 5 Best Gold ETFs in India 2023

- 5 Best Gold MF in India 2023

- How to Invest in Gold for Beginners

- How to Invest in Gold in Zerodha

Physical Gold Vs Digital Gold Investment

| Physical Gold Investment | Digital Gold Investment |

| Available in the form of raw gold, coins, bars, or jewelry. | Available in electronic form |

| You physically hold the gold and are responsible for its storage and security. | You don’t physically hold the gold but own a digital representation of it. |

| Bought and sold through jewelers, banks, and online marketplaces | Bought & sold on digital platforms, fund houses and stock exchanges |

| There is storage and insurance cost | Don’t require storage or insurance costs. |

| Provide a sense of security and tangibility | No such feeling present |

| Buying and selling takes time & physical effort | Easy buying and selling on a stock exchange or online platform |

| Can be damaged, lost, or stolen | Safely kept in a demat account or online. |

| Making charges are involved | Platform fees add to the overall investment costs. |

How Much Percentage of Your Total Investment Should be Gold

I suggest you allocating 10% to 15% of the portfolio value to gold as a diversification strategy.

Note – There is no one-size-fits-all approach, and what may be appropriate for you may not be suitable for another person.

How to Invest in Physical Gold in India

#1. Investing in Raw Gold

In my opinion, investing in raw gold is the best form of gold investment. The transactional charges are just 0.5% when I checked with my local jeweller, I think that is very low.

Your trusted family jeweler is the safest and the easiest source to get genuine raw gold. You can get scammed or end up buying fake gold if you buy from unknown jewelers or sources.

The drawback is that – there is no ready market for raw gold. You cannot go to the bank or online platform to deposit raw gold. You have to sell your raw gold back to the jeweller, preferably from whom you bought.

Note of Caution – Raw gold is not a regulated commodity in India. There can be a risk of fraud or misrepresentation.

Pros of investing in raw gold

- Low transaction charges – only 0.5%

- Raw gold is highly pure, you don’t worry about impurities or other metals mixed in.

- Collectors may be willing to pay a premium for raw gold that has unique features, such as a large size or unusual shape.

Cons of investing in raw gold

- Finding a trusted jeweller can be challenging

- GST extra if you take the bill

- The quality of raw gold can be difficult to assess, which increases the risk of fraud, scams, and buying fake gold.

- Challenging for new investors

My Take (4 out of 5)

Investing in raw gold is a better option compared to gold coins or ornaments due to its purity and lowest transaction charges.

#2. Investment in Gold Coins & Bars

This option is considered the next best after raw gold, with potential losses limited to 2-3%.

Gold coins and bars are easily available through banks, bullion dealers, and top brands in India. Brands like Tanishq, Kalyan Jeweller and MMTC-PAMP are reputable sources for 24k and 22k gold coins and bars.

Certified gold coins can also be purchased from Banks.

Below is the gold purity chart for beginner gold investors to understand the difference between 22 karats, 24 karats and other gold.

| Karat | Gold percent |

| 24 karats | 99.99% |

| 22 karats | 91.6% |

| 18 karats | 75% |

| 12 karats | 50% |

| 8 karats | 33.3% |

18-karat gold contains 75 percent gold and 25 percent other metals like copper or silver.

It is important to check for BIS hallmarking and request a purity certificate when purchasing gold coins and bars.

Keep in mind that there may be additional storage costs ranging from Rs. 5,000 to Rs. 20,000 annually when you keep gold in the bank’s safe lockers.

Pros of investing in gold coins and bars

- Easily available in banks and branded jewellery shops

- Can be easily bought or sold in the market

- Considered the purest form of gold

- Hallmarking makes it easier to assess the value accurately.

Cons of investing in gold coins and bars

- Transactional and branding charges. You may lose up to 5% of value.

- Needs proper storage arrangements to protect from theft or damage

- Additional GST charges apply

- Selling large gold bars requires planning especially during immediate fund requirements

My Take (3 out of 5)

If you want to keep physical gold as an investment with peace of mind of having a pure gold.

#3. Investing in Pure Gold Ornaments

Indians hold 25,000 tonnes of physical gold mostly in jewelry.

Pure gold ornaments are made of 22-karat gold with 91.6% purity, and have significance in Indian households as both an investment and a cultural symbol.

24 karat is almost 100 percent pure, but can’t be used to make jewellery because 24 karat gold is brittle resulting in jewellery breakage.

Gold is alloyed with copper or any other metal like silver (22-karat gold) so as to ensure that the jewellery does not break.

If you are buying gold coins and gold bars it would be 24 karats but if you are buying jewellery, it has to be 22 karats ideally.

List of branded jewellers from where you can buy gold

- Tanishq

- Kalyan Jewelers

- Joyalukkas Jeweler

- Malabar golds & Diamonds

- Tribhovandas Bhimji Zaveri

Pure gold ornaments investment’s potential loss is around 10-15%. You should calculate the final price of the ornament, which includes making charges, wastage charges, and a 3% GST.

Additionally, remember that purchases above Rs. 2 lakhs require a PAN card.

Some jewellers also offer gold schemes, allowing individuals to buy gold in easy instalments. You deposit a fixed amount every month for a pre-agreed period of time. You can purchase gold ornaments from the accumulated money at the end of the period under the scheme.

Pros of Investing in pure gold ornaments

- You can show off at parties and functions, providing a sense of satisfaction and boosting ego.

- Gold provides a hedge against inflation and economic uncertainties.

- Gold has a low correlation with stocks or bonds, which can help reduce overall portfolio risk.

Cons of Investing in pure gold ornaments

- High making charges

- Lower returns at the time of selling

- Risk of purity issues from jewellers

- Needs to ensure proper storage arrangements to protect them from theft or damage

My Take (1 out of 5)

Investing in pure gold ornaments is not recommended as it involves high making charges, lower returns, and the risk of purity issues.

#4. Investing in Gold Ornaments Studded With GemStones

Diamond earrings, emerald rings and ruby bangles are some examples of gemstone-studded gold ornaments.

The issue with gemstone studded jewellery is that it’s challenging to determine the purity of the stones until you visit a gemologist.

Gold ornaments studded with gemstones may seem appealing, but they come with certain drawbacks like

- Gems don’t appreciate in value like gold

- The risk of gemstone breakage is high

- Additional making charges range from 12% to 18%.

Ensure that the gold is weighed and billed separately to avoid paying extra if you choose this as the investment option.

Pros of investing in Gold ornaments studded with gemstones

- Holds sentimental and emotional value and can be passed down through generations.

- Gemstones may seem appealing

Cons of investing in Gold ornaments studded with gemstones

- No value return of gems in the ornaments

- Difficult to distinguish genuine gemstones

- Incurs higher costs due to involvement of the craftsmanship

- Gemstones are not traded as much as gold or diamonds.

- Gemstones may cleave and break into splinters during cleaning or polishing or can break the stone

My Take (0 out of 5)

One of the worst ways to invest in gold as it is only good as an ornament and beauty.

Taxation on Gold in India

For tax purposes, all 4 types of physical gold investment mentioned above are treated the same.

#1. LTCG on Gold Investments

Profit from physical gold held in any mode for more than 36 months before selling is considered as a long-term capital gain (LTCG).

You need to pay tax at the rate of 20% with indexation benefits.

LTCG = Sale consideration – Indexed cost of acquisition- Indexed cost of improvement (if any) – Expenses incurred exclusively for the sale of the Asset – Exemption u/s 54F if any availed.

Note – Section 54F of the IT Act allows tax exemption on gains from the sale of certain capital assets (other than a house property) such as stocks, bonds, and gold.

Exemption is allowed if the sale proceeds are used to buy residential property only.

Example – Suppose you bought physical gold in 2010 for Rs. 5 lacs and sold it in 2023 for Rs. 17 lacs. You spent Rs. 5000 as sale expenses and haven’t availed any exemption under section 54F.

Then LTCG calculation is under

Sale consideration = Rs. 17 lacs

Indexed cost of acquisition = 5 lacs x CII of 2023 / CII of 2010

= 5 lacs x 311 / 167 = Rs. 9.91 lacs

Check – Cost of inflation index (CII) of all the previous years

LTCG = 17 lacs – 9.91 lacs – 5000 = 7.04 lacs

If you invest all the LTCG in buying house property then you don’t have to pay any taxes.

If you don’t invest in house property then you have to pay taxes @ 20% on 7.04 lacs gains. The taxes come to 7.04 x 0.20 = 1,40,800 before cess and charges.

#2. STCG on Gold Investments

Profit from physical gold held for less than 36 months is considered a short-term capital gain (STCG). The tax rate is according to your current tax slab.

For example – you bought physical gold in October 2022 as an investment and sold at a profit of Rs. 2 Lacs in May 2023.

Transaction details –

Physical gold acquisition cost = Rs. 10 lacs

Sale consideration = Rs. 12 lacs

Expenses incurred for gold sale = Rs. 5,000

Then your short-term capital gain = Sale Consideration – Cost of acquisition- Cost of improvement (if any) – Expenses incurred exclusively for the sale of physical gold.

STCG = 12 lacs – 10 lacs – 5,000

= Rs. 1.95 lacs

Suppose you fall in the 30% tax bracket then you need to pay 1.95 lacs x 0.30 = Rs. 58,500 in tax before cess and surcharge (if any).

#3. Taxation on Gold Received as Gifts

You do not need to pay any taxes when you receive gold as a gift from close relatives, such as parents, siblings or children.

Taxes will be applicable if you receive gold from a non-relative if the value of the gold gift exceeds Rs. 50,000.

Note – Selling gold received as gifts will attract taxes as per STCG and LTCG norms.

#4. Taxation on Gold You Inherit

If you inherit gold from a blood relative, you do not need to pay taxes.

For other inheritances, you will have to pay taxes if the value of gold is above Rs. 50,000.

Here too, LTCG and STCG norms apply when selling the inherited gold. To determine the holding period, you need to consider the date of acquisition for the original owner of the gold items.

How Much Physical Gold Can You Keep at Home

Any amount of gold can be held with buying proof. Technically, there is no limit up to which you can own gold jewellery or ornaments in India.

Without buying receipt proof a married woman can keep up to 500 grams of gold jewellery and ornaments.

Unmarried women can keep 250 grams of physical gold at home.

Men are only allowed to keep up to 100 grams irrespective of their marital status.

Note – The above limits are not as per any specific law in India. But it is as per the instructions issued by The Central Board of Direct Taxes (CBDT) to its investigating officials at the time of the income tax raid.

How to Invest in Digital Gold in India

#1. Investing in Digital Gold

3 companies Augmont Goldtech, MMTC-PAMP India and Digital Gold India (Safe Gold) act as custodians for your digital gold.

Trusted brands like Paytm, Groww, Amazon Pay, Airtel Payment Bank, Motilal Securities, and HDFC Securities collaborate with these custodians to offer online investment in digital gold

For example, Paytm has tied up with MMTC-PAMP as custodian. When you buy digital gold on Paytm for Rs. 1000 MMTC-PAMP backs up your digital gold investment by buying and keeping actual physical gold in their safe lockers.

MMTC-PAMP will actually sell your gold and repay the money if there is redemption of the gold. Few online platforms like Paytm allow you to take delivery of the physical gold.

Investing in digital gold is convenient and accessible. For example, you can purchase digital gold on Paytm for as little as Rs. 1.

Note – there are transaction charges of around 2% and a 3% GST, with additional charges for conversion into physical gold and additional charges on courier and handling.

How to Buy Gold on Paytm Online

- Sign up on Paytm to create your account.

- Provide PAN and Aadhar and complete KYC identification.

- Fund your account using net banking, UPI or debit/credit cards.

- Choose the type and amount of digital gold you wish to invest in.

- Your gold is stored online in an electronic form with the platform.

Pros of investing in digital gold

- Gold can be easily bought and sold for as low as Re 1

- Convenient and hassle-free selling process

- Easy access to tracking your gold investments

- Get physical gold delivery when you want.

Cons of investing in digital gold

- High transaction charges of around 2%

- Additional 3% GST charges

- Charges may apply for conversions

- No regulatory authority

My Take (2 out of 5)

Considering the ease of purchase but relatively lower returns, I rate digital gold investments as 2 out of 5.

Taxes on Digital Gold

Digital gold investment is treated similarly to physical gold when it comes to taxation on gains.

The LTCG (gold investments held for more than 36 months) is taxed @ 20% with indexation benefits.

The STCG (gold investments held for less than 36 months) is clubbed with your income and taxed as per your tax slab rate.

#2. Investment in Gold Bonds

Sovereign Gold Bonds (SGBs) are issued by the Reserve Bank of India periodically. SGB carries a 2.5% coupon interest rate. SGB was introduced in 2015 with tax exemption on investment amount on maturity.

One unit of SGB bond represents 1 gram of digital gold. You can invest in SGBs through designated banks, post offices, or online platforms.

The price of the bond is based on the average closing price of gold in the previous week. SGBs have a fixed tenure of 8 years but offer the option to exit after the completion of the fifth year.

SGBs are traded on stock exchanges, providing an opportunity to exit before maturity. But they trade at a discount of 3% to 7% below the prevailing gold market rate, which is a drawback to consider.

Pros of investing in Sovereign Gold Bonds

- Fixed interest rate of 2.5% annually

- Profit of price appreciation at the end of the 5-year lock-in period

- Online trading option and tax benefits

- Potential for interest earnings, gold price returns, and tax benefits

- No transaction charges

- SGBs can be used as collateral when taking loans.

Cons of investing in SGB bonds

- SGBs have a lock-in period of 5 years

- No physical possession

My Take (5 out of 5)

This is the clear winner among the digital gold buying option as you will get interest + gold price returns + tax benefits + no transactional charges

How to invest in Sovereign Gold Bond

- RBI declares SGB issuance periods

- SGBs can be purchased through banks, post offices, and stock exchanges.

- Complete the SGB investment application, the amount you want to invest, and the relevant bank account details.

- Make payment using net banking or a demand draft.

- Receive confirmation and acknowledgment

- SGBs are issued in your demat account.

Taxes on SGB Gold Bonds

| Particulars | Time period | Taxes |

| Interest received | Anytime | Fully-taxable |

| SGB Redemption amount | If held till maturity | Exempted from taxes |

| SGB sold before 3 years | STCG | Normal tax rate |

| SGB sold after 3 years | LTCG | @20% with indexation benefits |

Note – Capital Gains (LTCG or STCG) would arise on the redemption of SGB or sale of SGB on the stock exchange

#3. Investment in Gold ETF

Gold Exchange-Traded Funds (ETFs) represent ownership of underlying physical gold. It tracks the price of gold where each unit of the ETF represents 1 gram of physical gold of 99.5% purity.

Gold Exchange-Traded Funds (ETFs) provide an alternative way to invest in gold. Gold ETFs are suitable for individuals who have a demat account.

Compared to digital gold, gold ETFs offer better returns in the absence of transaction charges is a benefit. On the downside, gold ETFs may have associated management fees.

How it is different from digital gold investment

Gold ETF and digital gold investment are conceptually the same. Both are backed by storing physical gold.

The difference is that the ETF is listed and stored in a demat account. But Digital gold is stored online in the platform (like Paytm) and can be sold back to the platform only.

Pros of investing in Gold ETF

- Easy buying and selling in NSE

- Low transaction and overhead charges than Digital Gold

- Directly tracks the price of gold

Cons of investing in Gold ETF

- You need to open a demat account

My Take (4 out of 5)

Considering the above factors, my rating for investing in gold ETFs is 4 out of 5 as it offers better returns than digital gold.

#4. Investment in Gold Mutual Fund

Gold Mutual Fund pools money from multiple investors to invest in various gold-related assets, like physical gold, gold ETFs, gold mining stocks, and gold derivatives. You don’t need a demat account to keep your gold mutual fund.

You invest in the units of a gold mutual fund, and the fund manager makes investment decisions on behalf of all the investors.

Difference between Gold ETF and Gold MF

| Particulars | Gold MF | Gold ETF |

| Mode of investment | Buy units in the mutual fund | Buy and sell units of the gold ETF on a stock exchange |

| Price | NAV at the end of each trading day | Real-time market value of gold |

| Expense ratio | Higher expense ratio compared to ETFs | Lower expense ratio |

| Liquidity | Bought or sold at the end of the trading day | Bought or sold throughout the trading day on the stock exchange |

| Minimum investment | Set by the fund company. Rs. 100 in SIP | Buy any number of units. |

| Demat account | Not required | Required |

Gold ETF is better for investors who are looking for

- Liquidity as Gold ETFs can be bought and sold on stock exchanges throughout the trading day.

- Investing in gold at a lower cost. ETFs have a lower expense ratio

- Passive investing as Gold ETFs track the performance of the price of gold.

Gold Mutual Fund is better

- For investors looking for better returns as gold MF are actively managed by professional fund managers

- If you are a salaried person and plan to invest regularly in small amounts using SIP.

Pros of investing in Gold Mutual Fund

- Easy purchase without the need for a demat account

- Can provide more returns than direct investment into gold

- Invests in different ways into the gold to provide diversification

Cons of investing in Gold Mutual Fund

- Management fees & transaction charges apply

- Exit charges if redeemed before 1 year

My Take (2.5 out of 5)

Better than Digital Gold but not as good as Gold ETF

Gold mutual funds offer better returns compared to digital gold, but the presence of management fees and exit charges should be considered.

Taxes on Gold ETFs and Mutual Funds

Gold mutual funds and Gold ETFs are treated similarly when it comes to taxation on gains.

The LTCG (gold investments held for more than 36 months) is taxed @ 20% with indexation benefits.

The STCG (gold investments held for less than 36 months) is clubbed with your income and taxed as per your tax slab rate.

5 Best Gold ETFs in India 2023

| Gold ETF | 5-Year Returns |

| IDBI Gold ETF | 13.79% |

| Invesco India Gold ETF | 13.69% |

| Axis Gold ETF | 13.66% |

| Aditya Birla Sun Life Gold ETF | 13.62% |

| SBI Gold ETF | 13.56% |

5 Best Gold MF in India 2023

| Gold Mutual Fund | 5-Year Returns |

| Invesco India Gold Fund | 14.20% |

| Axis Gold Fund | 13.99% |

| Kotak Gold Fund | 13.79% |

| SBI Gold Fund | 13.73% |

| HDFC Gold Fund | 13.62% |

How to Invest in Gold for Beginners

Digital gold is a great option for beginners who are starting their job and still unmarried, due to its convenience and accessibility. You can start investing in sovereign gold bonds or gold ETFs.

Married people can consider a balanced approach by allocating 50% of their investment to both physical and digital gold.

Note – There is no right or wrong way of gold investment. Take into account your personal preferences and comfort level with physical gold and digital gold investments.

How to Invest in Gold in Zerodha

You can invest only in Sovereign gold bonds, gold mutual funds and a few gold ETFs using Zerodha Coin.

Note– Zerodha allows Gold F&O intraday trading on MCX and not a long-term gold investment.

Steps to invest in gold in Zerodha

- Complete KYC by providing PAN, Aadhar and other details

- Log in to your Zerodha account and go to the “Coin” section

- Search for gold ETFs or gold mutual funds available on the platform.

- Buy a gold ETF or gold mutual fund by specifying the investment amount and complete the purchase transaction.

The price of gold can fluctuate, and market conditions can affect its value. Additionally, factors such as geopolitical events, economic conditions, and currency fluctuations can influence gold prices.

Beginners can start with Rs. 1000 per month of digital gold investment. With experience, you can allocate more to gold investment.

Ultimately, the amount you should invest in gold depends on your financial goals, risk tolerance, and overall investment strategy.

Gold has given 12% CAGR over the last 5 years. Gold has been considered a store of value and a hedge against inflation over the long term.

Investing in digital gold, gold ETFs or gold mutual funds can be a good starting point for beginners. These options provide ease of access, liquidity, and professional management of the investment.

Yes, NRIs are allowed to invest in gold in India. They can invest in gold ETFs, Gold Mutual Funds, and SGBs, subject to the rules and regulations set by the Reserve Bank of India (RBI) and other relevant authorities.

If you choose to invest in physical gold, you need to consider safe storage options to protect your investment. This can include bank lockers, secure home safes, or professional vaulting services.

Yes, you can take a loan against your gold investments through gold loan schemes offered by banks and financial institutions. These loans use your gold holdings as collateral, allowing you to access funds while keeping your gold investment intact.

The price of gold can be influenced by various factors, including global economic conditions, inflation rates, interest rates, currency fluctuations, geopolitical events, investor sentiment, and demand and supply dynamics in the gold market

Digital gold platforms, Gold ETFs, and Gold Mutual Funds typically offer the flexibility to invest in smaller quantities in the range of Re 1 and above.