Alice Blue Review 2024

Alice Blue Review 2024

Alice Blue charges Rs. 15 per order under the Freedom 15 (F15) brokerage plan.

Straightforward it means Rs. 5 per order saved as compared to the flat Rs. 20 brokerage charged by most of the peer discount brokers.

Helps if you are a regular trader who wants to reduce trading cost.

Considering 10 buy/sell trades a day and with 250 trading days in a year, you can save = 10 x 5 x 250 = Rs 12,500 annually.

Bonus – Alice Blue charges Rs. 0 for delivery trades.

- Alice Blue Brokerage Charges

- Alice Blue Margins Details

- Alice Blue Trading & Demat Related Charges

- Alice Blue Demat & Trading Account Review 2023

- Alice Blue 2-in-1 Demat Account Opening Process

- Alice Blue Trading Platforms Review

- Other Alice Blue Useful Tools & Services

- Why You May Prefer Alice Blue

- Final Thoughts

Alice Blue Brokerage Charges

Best thing – Alice Blue doesn’t have multiple or confusing brokerage plans.

Their only brokerage plan – Freedom 15 (F15) charges are –

| Segment | Brokerage |

| Equity Delivery | Rs. 0 per order – Free lifetime equity delivery |

| Equity Intraday (MIS) | Lower of Rs. 15 per order or 0.05% |

| Equity Futures | Lower of Rs. 15 per order or 0.05% |

| Equity Options | Rs. 15 per order |

| Currency Futures | Lower of Rs. 15 per order or 0.05% |

| Currency Options | Rs. 15 per order |

| Commodity Futures | Lower of Rs. 15 per order or 0.05% |

| Commodity Options | Rs. 15 per order |

The brokerage is charged lower of 0.05% or Rs 15, for example, if you place an order of Rs 1 lakh then the brokerage cost will be

Lower of 0.05% of 1,00,000 = Rs 50 or Rs 15, which is Rs 15.

In short, the lower brokerage of Rs. 15 per order or 0.05% works in your favor to optimize profits at a minimal cost.

Alice Blue Margins Details

| Segment | Intraday | For Cover Orders | For Bracket Orders |

| NSE & BSE Cash | 5x | N.A. | Up to 5x |

| NSE Futures | 1x | 1x | 1x |

| NSE Options | 1x on Sell | N.A. | N.A. |

| Commodity (MCX) | 1x | 1x | 1x |

| Currency (CDS) | 1x | 1x | 1x |

You can get a maximum margin of 5x with Alice Blue.

With peak margin suggested by SEBI applicable from September 01, 2021, all stockbrokers can allow margins as a maximum of 20% of trade value or 100% on applicable VAR +ELM.

Alice Blue Trading & Demat Related Charges

You can open a free 2-in-1 demat cum trading account at Alice Blue.

| Particulars | Charges/ Fees |

| Demat & Trading account opening | Rs. 0 |

| Demat Annual Maintenance Charges | Rs. 400 |

Depending on KYC verification, your demat cum trading account gets ready for trading within 24 hours.

Alice Blue offers limited investment products that are suited to beginner traders. You can get started with intraday trading in –

- Stocks (Equities)

- Derivatives (F&O)

- Currencies

- Commodities

And investing in –

- Shares and ETFs

- Mutual Funds

- IPO

One good thing is – they have a common account for NSE and MCX. You don’t have to pay extra money for a commodity trading account at NSE and MCX separately.

But you may miss fixed income securities like government bonds, NCDs and sovereign gold bonds investment options in Alice demat account.

Alice Blue Demat & Trading Account Review 2023

Alice Blue Financial Services P Ltd. (Alice Blue) is a 15-year-old SEBI registered (Registration number – INZ000156038), Bengaluru-based discount stockbroker.

They initially started commodity broking with MCX membership and later rolled into equities and the F&O segment.

More than 1 lakh customers use Alice Blue platforms.

Alice Blue bags the Gem of India award in 2013 and the Best Broking House- South from MCX 2018-19.

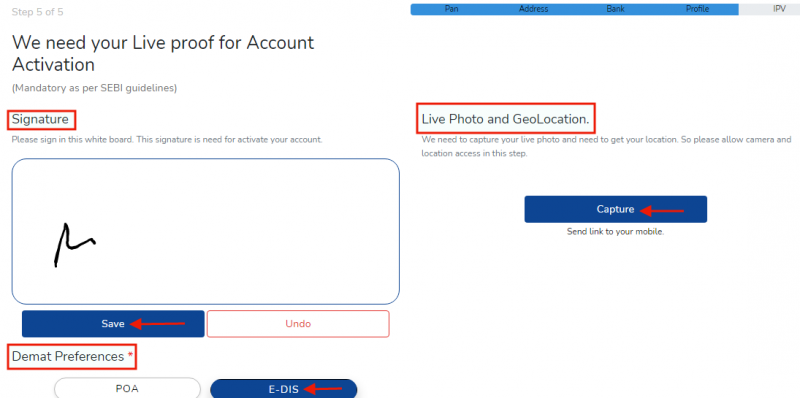

Alice Blue 2-in-1 Demat Account Opening Process

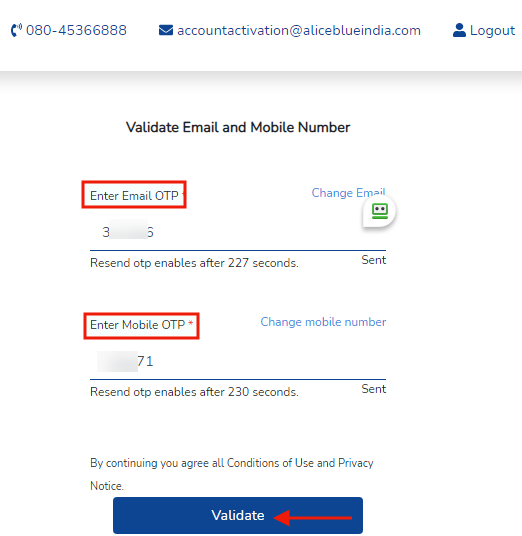

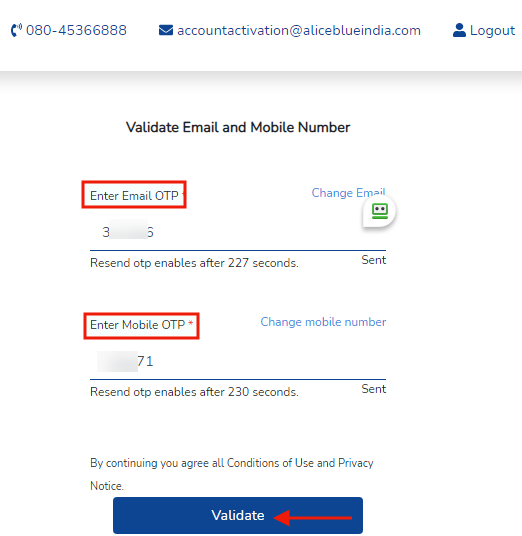

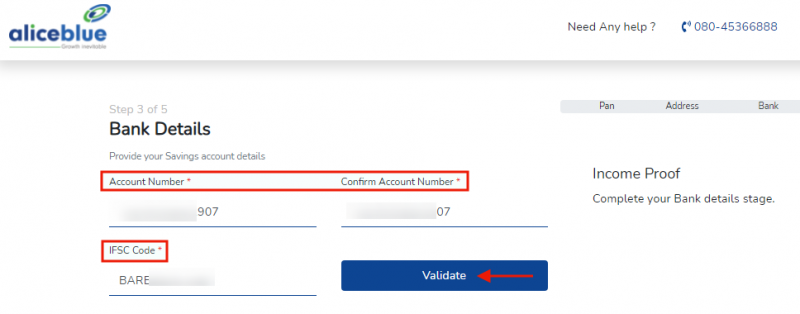

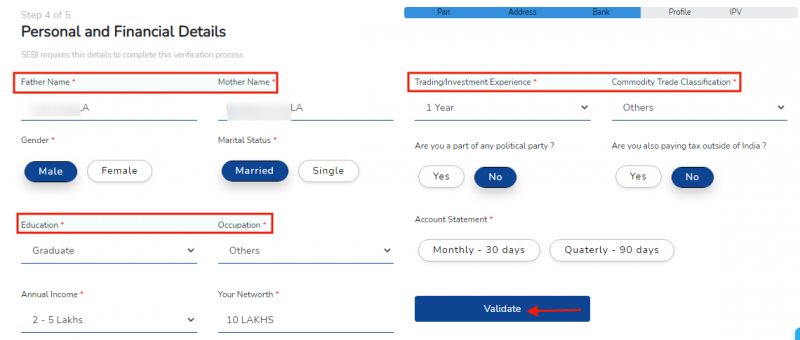

I have mentioned a step-by-step guide to open Alice Blue Demat & trading account

Step 1 – Visit the Alice Blue Demat account opening page

Provide your mobile number, email ID, PAN and date of birth to start the account opening process.

Step 2 – Fill in the Bank account information and click validate details.

Here you get an option to choose only the cash segment only. For trading in F&O, currency and commodity on MCX, you need to upload income proof.

Step 3 – Provide your personal details related to sex, occupation, income and trading experience.

Step 4 – Do an online e-KYC and send a digital signature and photograph.

Alice Blue Trading Platforms Review

Alice Blue employs “ANT” (Analyze and Trade) software – built by TradeLab. Supported by Omnesys NEST as a backend for its various trading platforms.

The platform allows real-time market data view, analysis of market movements and securities. Beginner traders will like the live streaming data, easy-to-follow option for placing orders and getting news feed.

ANT software allows –

- 20 Market depth

- Option Chain

- MTF Product

- Same day CNC selling allowed for NON-POA Clients

#1. ANT Mobi 2.0 Trading App

3.1 rated on the Google Play store and 3.7 on Apple App Store. Allows few tap order placement on NSE, BSE & MCX with multiple market watches.

Advanced charts with 100+ indicators and drawing tools help analyze securities, to get better information on trade, market depth and news.

ANT Mobi Trading app is supported by Android 6.0+ and iOS 11.4+ requiring lesser than 40MB of your mobile memory space.

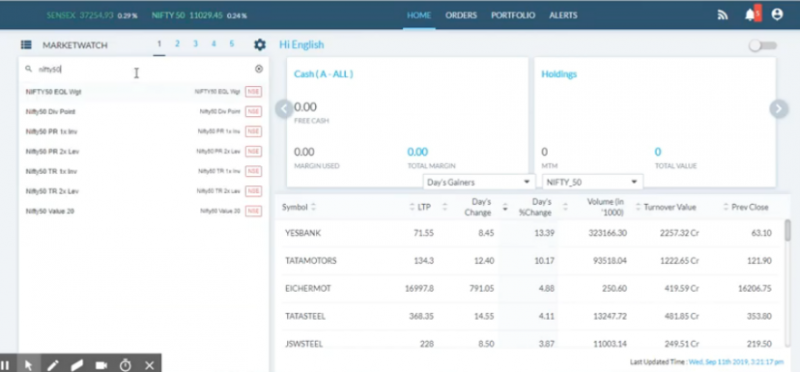

#2. ANT Web – Browser-Based Platform For Online Trading

ANT Web is a browser-based online web window for easy trading platform access with no additional software download requirement.

ANT Web trading platform is accessible on Windows, Mac and Linux operating systems through any of the web browsers like Google Chrome, Firefox. Microsoft Edge and Opera.

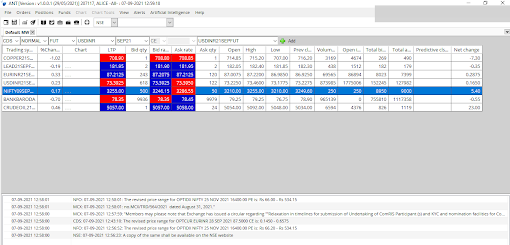

#3. ANT Desk For Fast Online Trading

ANT Desk is a NEST trading platform available in 32-bit and 64-bit downloadable .exe files creating faster trading environments on your local PC.

Professional traders can customize ANT Desk to suit their preferred trading style. ANT Desk application contains a professional charting package, pattern finders, real-time monitoring and risk management tools.

Both ANT Web and ANT Desk are front-end applications that allow you to get data of individual contracts and live market data & news.

You can –

- Log-in securely using 2 Factor Authorization

- Place quicker trades using short keys

- Get script details like lot quantity, tick size and series

- Look at real-time market depth using the “Snap Quote” option

- Manage position & portfolio using “Market Watch Toolbar”

- Execute one-click trading from charts

And perform several charting functions using 100+ technical indicators on 10 chart types. Chart types include candle charts, bar charts and Heikin-Ashi charts.

The platforms are decent in performance but are a notch below fast-paced trading platforms like Kite.

Other Alice Blue Useful Tools & Services

#1. Alice Blue Pledging Without POA Service

With Alice Blue, you can pledge your shares, ETFs, mutual funds and government securities online to get cash margins without the hassle of using the POA.

The cash margins received can be used in funding a trade opportunity in Equity intraday, Futures and Options trading.

Charges involved in pledging shares are –

- Rs. 15 per scrip on every buy and sell order irrespective of the quantity of stocks pledged

- 24% p.a. Interest on the debit balance

#2. Alice Blue Innovative Equity SIPs

With Alice Blue Equity SIP, you can systematically invest in a basket of equity, ETF or both. The service allows you to select stocks/ETFs for your basket and schedule the buy order time at your convenience.

The system automatically buys your selected stocks at the indicated time without you being required to remember.

The Equity SIPs can be flexibly planned for daily, weekly or monthly investment according to your strategy.

#3. Alice Blue Trade Store

You have access to paid products and services for enhanced trading on the Alice Blue trade store.

The goal is to improve your trading accuracy & profits.

The products include –

- Small case – for investment in a themed portfolio

- Mutual funds – direct mutual funds investment

- Algo & Bot products – for hands-free trading

The store offerings are suited for experienced traders who want to level up their trading and investment goals.

#4. Alice Blue Trade School and ANT IQ

Trade School is packed with hundreds of learning materials ( blogs, courses, expert video talks and webinars) suited for beginner traders before you dip hands in day trading.

Trade School courses are priced from Rs. 1 (basic level) to Rs. 5000 (expert level) and help you understand basics, algo trading, options, fundamental and technical research training.

ANT IQ is a platform with tons of helpful articles to explore more about intraday trading, technical indicators, patterns and the stock market.

Apart from that Alice Blue account gives you access to –

- Pivot points – showing stock price change levels

- Whatsapp reports – on companies, stocks, industry and economy

- RMS Live updates – on your trading position

#5. ANT Plus – Free APIs

The APIs (Application Programming Interface) connect online live data (stock market data) with the end-user.

With APIs, you can build your own trading platform or can create your own customized algo trading strategy.

Professional traders can use APIs to integrate their customized build trading platforms with MT4 or Amibroker websites for global currency trading.

Alice Blue APIs offers free web socket data after account opening. You get access to live market data helpful to position & analyze your trades.

Why You May Prefer Alice Blue

If you are cost-conscious and like to pay Rs. 5 less then you should open an account with Alice Blue.

Also suited to High volume- large value traders who can at least save Rs 12,500 annually.

Their USP lies in –

- Flat Rs. 15 brokerage charges for Intraday and F&O trades

- Rs. 0 charges for delivery trades

- Free – direct mutual fund investment

- Access to services and tools like – Trade store, Pivot points and Whatsapp reports

You also get a chance to participate in Alice Blue referral program. The program allows you to earn Rs. 500. And an additional 20% lifelong commission on the brokerage generated by your friend.

Things to Improve

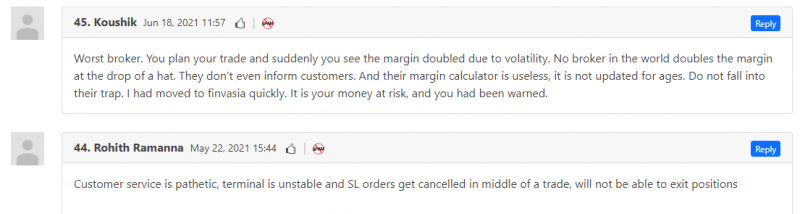

Customer Support

Alice Blue has multi-lingual branch support and their physical presence is limited to 15 branches across India. But we have found some customers face issues with the quality of customer support.

Alice Blue needs to ramp up customer support.

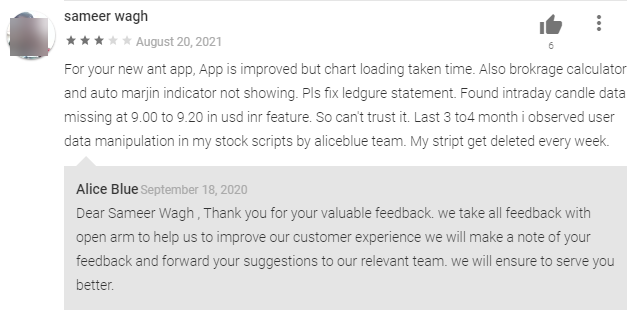

Platform Issues

We also found reviews of trade getting frozen and platforms hanging at peak traffic loads with people complaining of not being able to exit positions.

Some people also face difficulty with login issues, slower chart loading, missing candle data on a certain security.

Alice Blue needs to upgrade its platform infrastructure.

Other issues –

- No option to invest in Bonds, NCD, and Corporate bonds

Final Thoughts

Alice Blue offers a simple brokerage structure, 5x leverage, APIs and tools with a decent trading platform.

Beginner traders will find Alice Blue flat Rs. 15 charges the cheapest way to learn, practice and get hands-on with intraday trading & F&O trading.

On the other hand, high-value, high-volume traders can optimize cost and maximize trading profits.

Do you find Pmnews.ng, Best information Website on Insurance, Investment, Healthy Tips useful? Click here to give us five stars rating!